Despite the Strongest Labor Market in Years

But what is going to show up to banks and automakers while the cycle turns?

Serious vehicle-loan delinquencies – 90 days or extra late – jumped to four.69% of excellent vehicle loans and rentals within the first sector of 2019, consistent with New York Fed statistics. This positioned the automobile-mortgage delinquency fee at the very best stage in view that Q4 2011 and merely fifty-eight basis factors underneath the peak in the course of the Great Recession in Q4 2010 (5.27%): These souring car loans are going to affect banks and specialized lenders along side the real economic system – the automakers and automobile sellers and the industries that guide them.

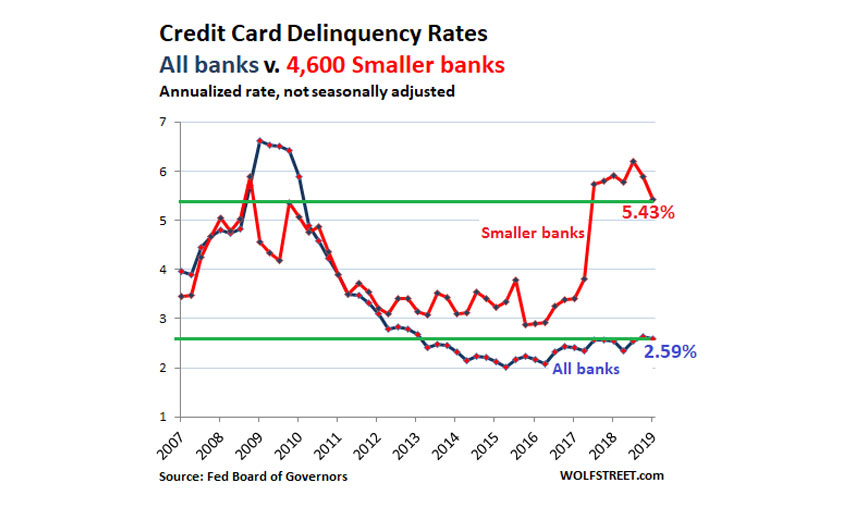

This is what the banks are searching for.

The bucks are big. In Q1, total outstanding balances of auto loans and rentals rose with the aid of four% from 12 months ago to $1.28 trillion (this quantity via the New York Fed is slightly better than the quantity pronounced with the aid of the Federal Reserve Board of Governors as part of its customer credit records). Over the beyond a decade, because in Q1 2009, general auto loans and rentals notable have risen with the aid of 65%. But the variety of car-loan debts has risen most effective 34% over the last decade, to 113 — nine million money owed in Q1 2019. In different words, what brought about a great deal of the increase inside the car-loan balances is the ballooning quantity financed with each new mortgage and longer loan phrases that cause those loans to stay at the books longer.

The chart under suggests the dollar quantities of auto mortgage balances (blue columns, right scale) in trillion bucks and the number of vehicle-loan accounts (red line, left scale) in tens of millions: Of this ballooning amount of auto loans, 4.67% is significantly delinquent (ninety+ days). This quantity to $60 billion. This chart suggests the trajectory of what the banks and specialized lenders are going through, in billion dollars:

For lenders, these delinquent loans don’t represent total losses. This debt is collateralized using motors, which may be repossessed without tons of a delay – not like foreclosing on a residence. The mortgage amount is usually far higher than what a repossessed car will convey at the public sale. Perhaps the banks can get a better 50% on common of the mortgage amount. So, if all of the modern-day vintages of ninety+ day delinquencies turn into repossessions, and the banks lose 50% on them, it’d quantity to $30 billion in loan losses. But more loans are going delinquent at the same time as we talk, and they will grow to be severely antisocial in Q2, the next batch in Q3, and so on, and this is working itself ahead after wave. So the cumulative losses over the subsequent years may be better.

These losses are unfolded over hundreds of banks, credit score unions, and specialized non-bank creditors. Over asset-sponsored securities holders, including pensions finances, other institutional traders, and bonds price range, and most will get thru this using simply licking their wounds. But a few smaller subprime-targeted non-financial institution creditors will fall apart, and a few have already collapsed. So these defaulted car loans are going to harm, and that they’re going to take down a few smaller creditors; however, they’re no longer going to take down the US banking device. They’re just no longer huge sufficient.

This is what automakers are dealing with.

Lenders have already found out that subprime car loans have soured. They’ve seen this when you consider that 2015 or 2016. And ever so gradually, lenders have tightened their subprime underwriting requirements. Subprime clients who don’t get approved for brand new-car loans can also get approved for a far smaller mortgage for a less expensive used automobile. This manner has already been transferring ability new-car clients to used automobiles.

For automakers, this has already proven up in their sales. In terms of vehicles added to stop-customers, new-automobile sales peaked in 2016 and have been declining ever given that. Through Q1 this 12 months, new-motors sales, fleet, and retail, have been down three.2% from Q1 2018, and so 2019 seems to be any other down-yr for the industry – the third in a row.

But this isn’t occurring in a recession, with hundreds of thousands of people losing their jobs and defaulting on their auto loans because they lost their jobs. This is going on during one of the most powerful labor markets in lots of years. It’s occurring when the economy is growing at around three% 12 months. It’s taking place in suitable instances. And human beings with jobs are defaulting.

This is not a signal of a worsening economic system. Still, a result of years of aggressive and reckless auto lending, aided and abetted through yield-chasing investors piling into subprime auto-loan-backed securities because they offer a bit more yield in the technology of relevant-financial institution engineered monetary repression. Like so many others on this economy, it’s a sign that the complete credit score spectrum has gone haywire through the years. Thank you, Fed, for having engineered this entire element together with your imaginative guidelines. So now there’s a rate to pay – even at some point of proper times.